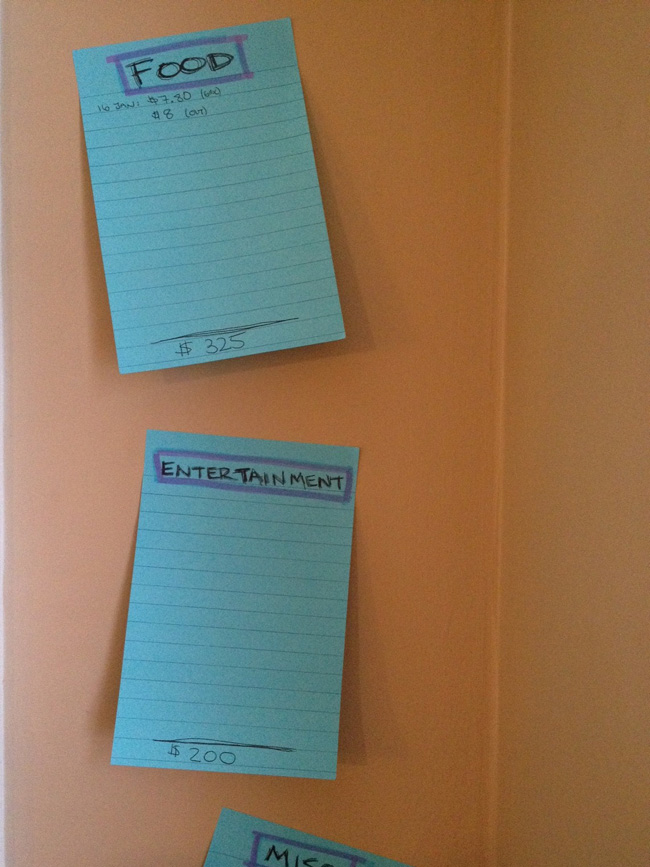

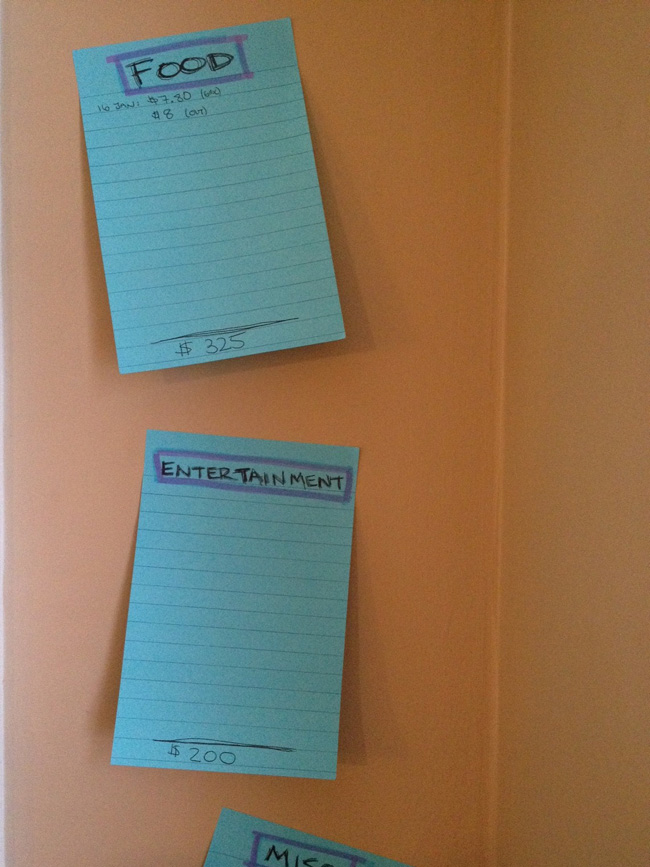

家のドアに張り付けたメモで毎月の出費を管理。 JACKIE HOFFART PHOTO バンクーバーの映画学校に通い始め、30歳にして貧乏学生となったジャッキーは、必要にかられ、自らに節約という挑戦を課すことにしました。節約は得意ではないと言いますが、果たしてどんなやり方でお金を切り詰めるつもりなのでしょう?

I'm rubbish at budgeting. I think the only reason I've survived without going bankrupt is because I don't have extravagant tastes and, generally speaking, I live a simple life.

However, I do have things I like to spend money on — namely, eating and drinking. It's a rare day that I don't buy myself a coffee and it's a rare week that I don't spend a couple of nights out eating and drinking with friends. These add up.

The relationship to money that I inherited from my parents is an out-of-balance save/ splurge mentality. I think their idea was: Live simply, but treat yourself occasionally, especially on payday or Christmas. My problem is that I can always think up a reason why today is a good day to treat myself.

But enough is enough. I'm a student again now and I'm on borrowed money, which means I need to be on a budget.

The catch for me is that I'm 30. I've grown accustomed to the kind of lifestyle a full-time job and salary can afford. It's hard to go back to living a stripped-down student life. There are certain concessions I just can't make.

I need to live by myself — no house-sharing with smelly strangers! I need nice cookware so that I can make nice food in my kitchen. It doesn't help that I like nicer wines than I did 10 years ago, either.

The first step in setting a budget for myself was to track my spending. I downloaded a few apps that purported to help keep track of my spending. The deeper I got into analyzing my spending, the more I realized that this isn't a challenge I could pull off in a few weeks.

Based on my analysis, and on trends and tips I've heard over the years (but ignored), I've set myself some new spending guidelines. I'm going to follow them closely for the next two months and report back in mid-March to let you know how it went.

A good rule of thumb, I'm told, is to spend roughly a third of your income on rent/housing. Let's ignore the fact that I have no real income and use my rent as a fixed point: I pay C$650 (49,000 yen) per month, which includes heating and electricity.

Internet and a cell phone should cost another C$100 (7,600 yen) per month. Food prices have gone up about 25 percent since I lived in Canada a decade ago, so I now get even less bang for my buck. Even so, I should be able to do batch cooking (for example, making a big roast on Sunday and using that in the week's dishes). My total food spending (including groceries and eating out) needn't be more than half my rent. If it is, I'm eating too much. So that's something like C$75 (5,600 yen) per week on food, just over C$10 (760 yen) per day. Should be plenty.

I will bolt on another C$200 (15,000 yen) per month for going out, although as a student, I should really be studying and not going out so much.

One also has to add at least an extra C$100 (7,600 yen) per month into "miscellaneous." For example, this month, that means paying for a lot of household items, because I just moved house. Next month it might be that I pay to get my bicycle fixed, or another month it might be new contact lenses ... there's always something.

So, my monthly budget looks like this:

C$650 (rent)

C$100 (bills)

C$325 (food)

C$200 (entertainment)

C$100 (miscellaneous)

C$1,375 (104,000 TOTAL yen)

There are other things that will affect this budget, like school tuition, books and school expenses, of which there are many in film school, but in general, I think this is a good plan. I should be able to hit this realistically.

I will monitor myself by adding up all my spending onto big sticky notes on the back of my door. I need to be reminded of my budget all the time, to make it part of my life. And that means learning to love my budget instead of being afraid of it.

Next time: What if I ... sleep eight hours a night?

|